Roads & PavementRoads & Pavement

Barefoot

Minimal

Low

Medium

High

Maximal

All around running shoes offer comfort and cushioning for daily runs, jogs, walks, and long mileage. They offer enough versatility for both faster and slower runs and are a great option for those who want one running shoe to do it all.

Fast run or uptempo running shoes are lightweight and responsive. They offer streamlined designs that have minimal uppers and offer a high level of energy return. These shoes are a great option for faster runs in the week or those looking for a livelier experience.

Max Cushion shoes offer premium cushioning with ample ground protection and a stable ride. These types of shoes provide abundant impact protection that softens landings while running at any pace or distance. These types of shoes are best for slower recovery runs and easy days where comfort takes priority.

Racing shoes are designed with optimal performance in mind. These types of shoes have snug-fitting uppers, energetic midsole foams, and features implemented for maximum efficiency. These types of shoes are best for runners looking to gain the ultimate advantage in races but may sacrifice some durability and comfort.

Gym Workout shoes offer a stable and versatile ride. They have a firmer underfoot feeling that provides stability for lateral movements with comfortable uppers. These types of shoes are best for trips to the gyms, cross training, casual wear, and light running. HSN Code GST Rate for Gold silver diamond pearls etc

Road running shoes feature smooth outsoles that are designed for running on paved surfaces such as roads, sidewalks, and bike paths.

Designed to handle most trail runs, these shoes prioritize comfort and a smooth ride. These shoes are great for anything from smooth singletrack, park trails, and fireroads making them ideal for those who run from their doorstep on streets before hitting the trail.

These shoes are best used for hard, rugged trails such as shale, granite or sandstone where grip on smooth surfaces and underfoot protection are important.

Designed for use in muddy, soggy conditions, these shoes feature very aggressive outsoles that dig deep into soft ground for exceptional traction.

These shoes feature technical outsoles designed to grip snowy and icy trails making them ideal for winter trail running.

Cushioning level, or stack height, refers to how much shoe is between your foot and the ground. For this category, we reference the amount of cushioning below the forefoot as the heel height will be equal to or greater than the forefoot height.

GST Rates in India 2024 List of Goods and Service Tax Rates

0-13mm. The Shoe generally does not have a midsole and feels like there is no cushioning. This shoe is all about feeling the ground underfoot.

14-18mm. The shoe has a thin midsole that allows for a natural running experience. Racing shoes and minimalist shoes are common here. These shoes offer a feeling of being connected to the road or trail.

19-23mm. The shoe has a slightly cushioned feel and may feature added cushioning technologies. Performance training shoes and some trail shoes are common here. These offer protection during footstrike but prioritize a lightweight, grounded experience.

24-28mm. These shoes have a stack height that fall near the middle of the spectrum.The shoes in this category are verstaile and great for all types of runs and distances.

29-34mm. The shoe has a thick midsole and ample cushioning. These shoes are highly protective and absorb more impact than the body.

35mm plus. The shoe has an extremely thick midsole and extra cushioning. The focus is on protection and soft foam underfoot with hardly any ground feel.

Neutral shoes support the foot through a normal range of arch collapse and generally do not have a built-in technology to correct movement.

Stability shoes are a great option for those who overpronate or need added support. These shoes help to limit the inward rolling motion of the ankle while running or walking and assist in guiding the foot straight through the gait cycle. Industry hails GST rate cuts decision to allow quarterly filing

Product Details:

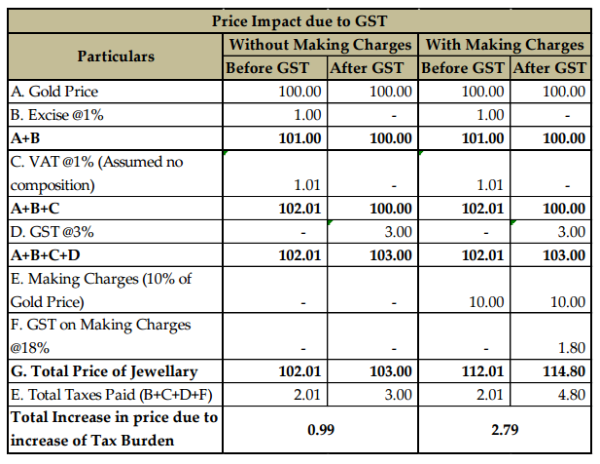

Centre States May Settle For 4 GST on Gold Silver Advisory sale, All you should know about 3 GST on gold silver and processed sale, Standing Committee on Finance recommends reducing GST rate on sale, Structure of GST in India Impact On Small Businesses sale, Silver Scrap Rate Today Current Price Updates Scraprate.in sale, Silver Price in Goa Today s Live Silver Rate Online sale, The GST Council Announced Tax Rate Changes July 2022 sale, GST gold rate at 3 Why the government made a new slab altogether sale, Explained Will India s Goods and Services Tax rates be sale, GST News Around 94 percent of polished diamond to benefit from sale, Different pumps and their GST rates applicable Sehra Pump sale, GST Rate HSN Code for Nickel and articles thereof Chapter 75 sale, Revised GST rate on real estate 2024 sale, Converging GST rates Needed but not now sale, GST Exemptions on Gold Silver and Platinum IndiaFilings sale, CBIC clarifies on GST rates classification for 12 Category of goods sale, Are you prepared for the upcoming GST rate change in Singapore sale, Full list of Rate and HSN Code of GST Goods Latest Law and Tax News sale, Ankita Singla and Associates Really liked the way they have sale, GST Rate HSN Code for Miscellaneous articles of base metal sale, Gst Rate On Gold And Silver Worldwide Shipping transparencia sale, gst rate on gold coin and silver coin GST PORTAL INDIA sale, GST Council finalises tax rates for remaining items States agree sale, GST Council meet From coffee to hotel rooms check what became sale, From Oil To Atta Prices Have Soared Across Essentials Now GST sale, Gst Rates for Iron Steel Products in India sale, HSN Code and GST Rate for Aluminium and Aluminium Products sale, 999 1 g Silver Coin Only with GST Billing at Rs 111 in Ahmedabad sale, Six Years Of GST Rs 1.5 Lakh Crore Monthly Tax Revenues Becomes sale, Snack Food Association demands 5 GST rate on food products sale, Gold Traders divided on gold GST rate The Economic Times sale, GST on Gold Effects of Gold GST Rate in India 2024 sale, GST on Salary 18 GST on salary paid for services by a firm to sale, GST Fitment Committee proposes hiking GST Slabs and on Gold and Silver sale, Jewellery exporters seek duty exemption under GST Commodity News sale, How To Calculate GST . Goods and Services Tax or GST is an by sale, 999 1 kg Silver Cast Bar Only with GST Billing at Rs 47294 piece sale, Industry hails GST rate cuts decision to allow quarterly filing sale, GST Rates in India 2024 List of Goods and Service Tax Rates sale, HSN Code GST Rate for Gold silver diamond pearls etc sale, GST Impact Study for Jewellers sale, Everything to Know about Taxes on Silver in India sale, Impact of GST On Gold Silver in India Goyal Mangal Company sale, 999 25 g Silver Coin Only with GST Billing at Rs 1350 in sale, GST GOLD SILVER CALCULATOR Apps on Google Play sale, GST Impact on Gold and Silver sale, Business Standard on X sale, GST for gold silver and others. What is the rate of GST on gold sale, GST on Gems Jewelry A Detailed Analysis sale, GST Rates in India 2024 List of Goods and Service Tax Rates sale, Product Info:

Gst rate of silver sale.

- Increased inherent stability

- Smooth transitions

- All day comfort

Model Number: SKU#7451209